Homeowners and potential buyers have been grappling with higher mortgage rates since 2022. This trend can be attributed to several key economic indicators that continue to exert upward pressure on borrowing costs. Let’s explore three primary reasons why mortgage rates have remained elevated.

1. A Robust Job Market

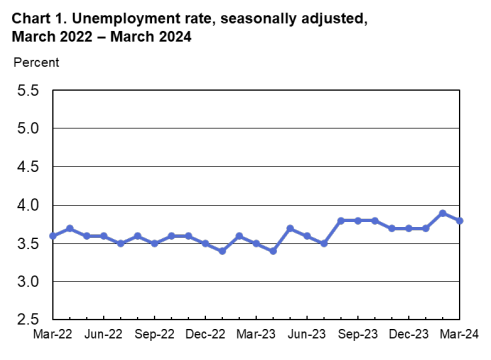

The resilience of the job market is a major factor influencing the Federal Reserve’s monetary policy, which in turn can affect mortgage rates. March’s employment data revealed an addition of 303,000 new jobs, surpassing the expectations of many economists. Furthermore, the unemployment rate has stayed below 4% for 26 consecutive months, resting at 3.8% recently:

This robust job creation and low unemployment rate signify a strong labor market, a critical metric for the Federal Reserve as it battles inflation. The Fed uses these indicators to gauge the health of the economy and to make decisions on interest rates. As long as the job market remains strong without signs of cooling, it is likely that the Fed will maintain its current monetary stance to prevent the economy from overheating.

2. Persistent Inflation

Inflation continues to be a stubborn issue, with the latest Consumer Price Index (CPI) showing a 3.5% increase, significantly above the Fed’s ideal target of 2%. High inflation is concerning as it erodes purchasing power and can lead to economic instability. The Federal Reserve has a dual mandate: to ensure price stability and maximize employment. This mandate guides their cautious approach towards interest rate adjustments.

As long as inflation remains above the target, the likelihood of a reduction in interest rates remains slim. The Fed would likely need to see a considerable economic slowdown or a significant drop in inflation before considering lowering the rates.

3. The Influence of the Bond Market

It’s important to recognize that the Federal Reserve does not directly set mortgage rates; these are more closely tied to the 10-year Treasury yield. While Fed rate adjustments can indirectly influence bond yields, other factors also play crucial roles. These include international monetary policies, recession risks, and the performance of various asset classes like stocks and cryptocurrencies.

Consequently, even if the Fed decides to lower interest rates, mortgage rates may not necessarily follow suit immediately. They are influenced by a broader array of economic activities and market perceptions.

Given the current economic indicators—strong job market, persistent high inflation, and the complexities of the bond market—significant reductions in mortgage rates seem unlikely in the near future. These rates are not only a reflection of domestic economic policies but also of global economic conditions and investor sentiment. As such, potential homebuyers should prepare for continued high rates for the interim.

Head over to our interactive Mortgage Calculator to see how your payments change based on interest rates, down payments, and mortgage terms.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link