Are you looking to buy a house but want to keep your monthly mortgage payments as low as possible? You’re not alone. Many homebuyers are searching for strategies to reduce their monthly outgoings, especially in today’s market.

One common approach is to negotiate the purchase price down with the seller. As I’ve discussed in previous videos, this is a smart move in the current market conditions. However, if you’re focused on minimizing your expenses this year, there’s another effective strategy to consider: buying down mortgage points.

What exactly does this mean? Buying down mortgage points involves prepaying interest to lower your mortgage rate. Let’s break this down with an example.

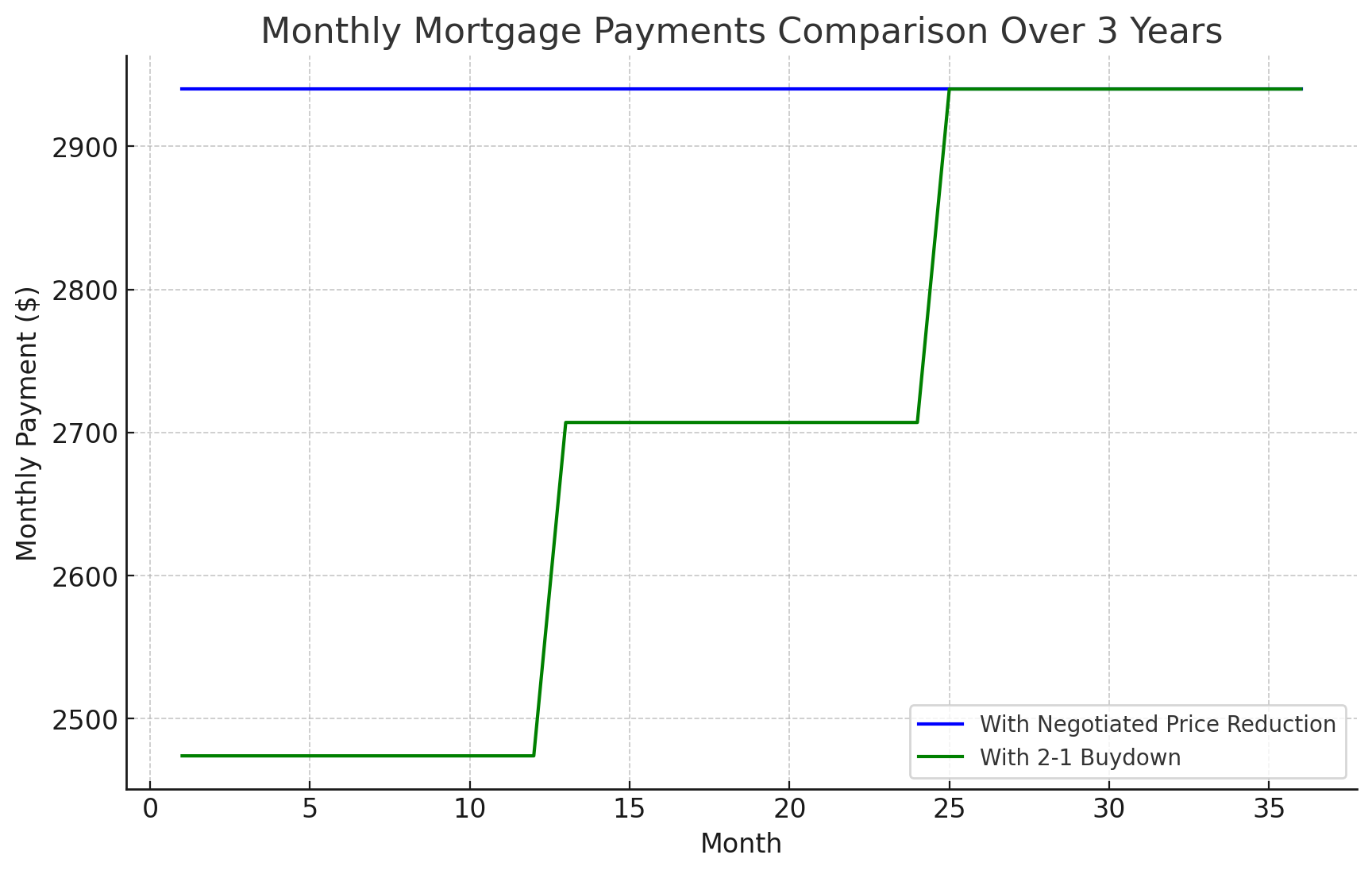

Suppose you’re able to negotiate a $25k reduction in the purchase price, which lets you borrow $475k on a 30-year fixed term at 6.3%. Your monthly payment would then be $2,940.12 for the duration of the loan, saving you $154.74 per month thanks to the price negotiation.

However, imagine if instead of reducing the purchase price, the seller agrees to contribute that $25k towards a 2-1 mortgage buydown. In this scenario, your interest rate is reduced by 2% in the first year and 1% in the second year, before reverting to the original rate from the third year onward. This adjustment would lower your first-year monthly payment to $2,474, saving you an additional $465 in Year 1 alone. The savings decrease in Year 2 and revert to the original payment in Year 3. You can see these differences clearly illustrated in the graph shown right now.

It’s important to note that this strategy isn’t suitable for everyone. You should only borrow what you can comfortably afford and consult with a mortgage broker to tailor advice to your specific situation.

However, if you expect your financial situation to improve in the second year and beyond, a 2-1 buydown could be a more beneficial approach than simply negotiating a lower purchase price.

Head over to our interactive Mortgage Calculator to see how your payments change based on interest rates, down payments, and mortgage terms.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link