If you don’t know whether its cheaper to rent or buy in 2024 do this quick calculation.

Do what some property investors do and use the Rent-to-Vale (or RV ratio) ratio to help you decide. (insert picture)

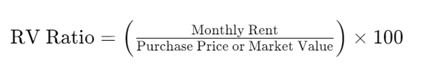

This compares rental yield to property value and is calculated for an area by dividing the median monthly rent by the median home price and then multiplying by 100, like this:

For example, if the median rent in Sarasota is $3,000 per month and the median home price is $530,000 (which they are at the time of writing), the RV ratio is 0.56%. This gives a snapshot of how much rental income a property could generate relative to its price.

RV ratios below 0.5% indicates that renting is cheaper because the rental income relative to the home price isn’t very high—meaning you might pay more per month to own a home than to rent one.

An RV ratio above 0.7% points towards buying as a potentially more profitable decision.

So an RV ratio between 0.5% and 0.7% is more nuanced, and whether to buy or not will depend on personal circumstances. long-term plans, and how much value you place on the non-financial aspects of owning a home such as like equity build-up and potential appreciation.

If the RV ratio is a major factor in your decision, renting appears more favorable at the current ratio of 0.56%.

Its not perfect but definitely gives you a fast indication as to what markets are overheated quickly.

Ready to explore your dream home in sunny Sarasota? Contact me today to start your journey! Whether you’re buying or selling, I’m here to help you navigate every step of the way.

Enjoyed this article? Get More Tips, Updates, and Exclusive Insights Delivered Straight to Your Inbox!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link