The Florida new construction market is showing early signs of softening, and one of the biggest indicators is coming from the builders themselves. Recent data reveals that homebuilder layoffs are on the rise in key Sun Belt markets, including Tampa, Jacksonville, and across the state of Florida.

But what does this mean for buyers, sellers, and investors in 2025? Let’s break it down.

Why Homebuilders Are Cutting Jobs

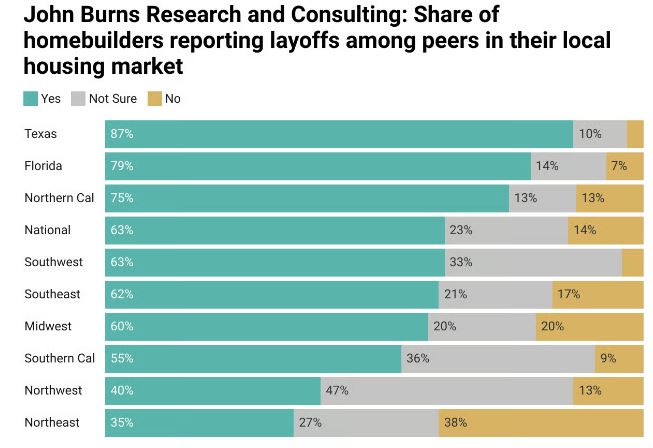

According to a recent survey by John Burns Research and Consulting, 79% of Florida builders reported recent layoffs, a stark contrast to the Midwest and Northeast, where builder job cuts remain far less common.

The reason is simple: unsold new-build inventory is piling up. With more completed homes sitting on the market and buyers pulling back due to affordability concerns, builders are losing some of their pricing power. To protect margins, many are slowing down on speculative construction and trimming staff.

How Big Is the Pullback?

The job losses so far are modest but notable:

-

Residential building construction employment is down 3,800 jobs (-0.4%) from its March 2025 peak.

-

Residential specialty trade contractors: the subcontractors who handle everything from plumbing to roofing are down 44,000 jobs (-1.8%) from September 2024.

On their own, these aren’t dramatic numbers. But historically, residential construction employment tends to soften ahead of broader economic slowdowns, making this a trend worth watching.

Florida’s Market vs. the Nation

Florida, along with Texas, is at the epicenter of this shift. With heavy new-build activity over the past decade, Sun Belt states have seen faster increases in inventory.

By contrast, builders in the Midwest and Northeast report little to no layoffs, showing how regional housing dynamics are diverging.

For Florida specifically, this cooling could signal more negotiating power for buyers who are shopping for new construction in 2025. Builders facing higher inventory may offer stronger incentives, mortgage rate buydowns, or price adjustments to move product.

What Builders Are Saying

Despite the layoffs, builder executives are signaling that labor availability is not a concern right now. In fact, many builders are reporting shorter construction timelines thanks to greater availability of trades:

-

D.R. Horton’s CEO Paul Romanowski noted that trades are “looking for work,” allowing faster build cycles and some cost savings.

-

PulteGroup’s CEO Ryan Marshall emphasized that labor costs remain stable and that the company continues to attract available workers.

-

Meritage Homes CFO Hilla Sferruzza highlighted that slower multifamily construction has freed up labor in their key markets.

In other words, the challenge isn’t finding workers….. it’s finding buyers.

What This Means for Florida Buyers and Investors

For anyone considering a move or an investment in Florida real estate, here’s what to take away:

-

Opportunities for Buyers: With builders facing pressure, now may be the time to secure incentives such as closing cost assistance, design upgrades, or below-market mortgage rates.

-

Signals for Investors: Rising inventory and softening demand could create short-term volatility but also potential discounts on both resale and new-build homes.

-

Sellers Should Stay Competitive: If you’re listing in a market with high new-build activity, you’ll need to price strategically and highlight your property’s unique advantages.

Looking Ahead

While the current decline in construction employment is relatively small, history suggests it’s a trend worth monitoring. If layoffs accelerate, it could foreshadow broader weakness in housing demand. On the other hand, if lower mortgage rates emerge from a slowing economy, that could reignite buyer demand and stabilize Florida’s housing market.

For now, Florida homebuyers and investors have a window of opportunity. Builders are motivated, incentives are available, and inventory is more plentiful than it was just a year ago.

Final Thoughts

The Florida real estate market in 2025 is shifting. Builder layoffs are an early warning sign, but they may also mark the start of a more favorable environment for buyers and savvy investors. Whether you’re considering a relocation, looking for a primary home, or evaluating fix-and-flip opportunities, staying informed is key.

If you’re thinking about buying or selling in Florida and want tailored guidance on navigating today’s market, reach out, I’d be happy to help you evaluate your options.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link