Understanding the Sarasota real estate market, especially factoring in mortgage rates, can be tricky. As an experienced real estate agent in Sarasota, I aim to simplify things and help you decide wisely. Let’s dive into the current landscape of mortgage rates and what it means for you as a home buyer in Sarasota.

Current Mortgage Rate Trends

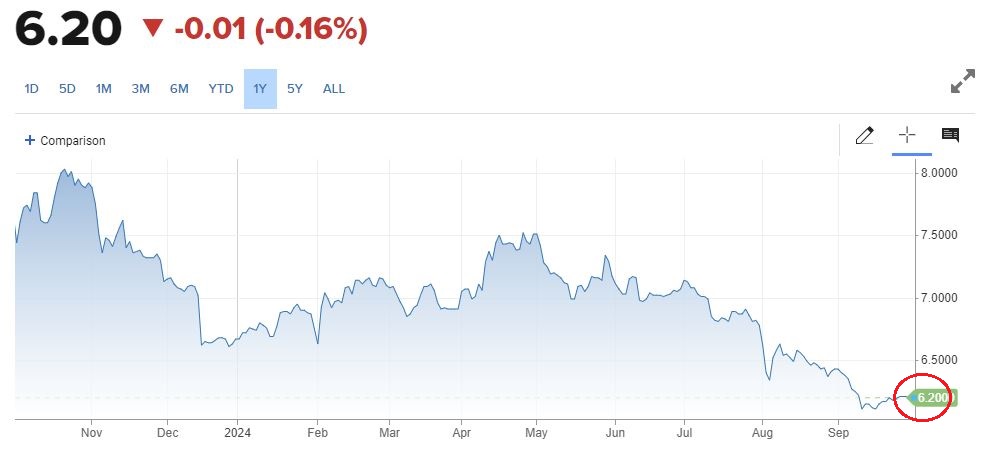

Recently, the Federal Reserve cut the fed funds rate by 50 basis points, marking the first cut in over four years. This decision has led to a decrease in mortgage rates, which are now averaging 6.20% for a 30-year fixed mortgage, according to Mortgage News Daily, which is the lowest they have been for over 12 months:

Factors Affecting Mortgage Rates: Current mortgage rates in Sarasota depend on many factors, including Federal Reserve policies, economic conditions, and inflation. Understanding these factors can help you decide when to lock in your rate.

Impact on Buying Power: Lower rates can make buying a home in Sarasota more affordable. They lower monthly payments and let buyers qualify for bigger loans. For example, a 1% drop in mortgage rates on a $400,000 home could save you over $200 per month! However, it’s essential to keep in mind that the market remains competitive.

Head over to our interactive Mortgage Calculator to see how your payments change based on interest rates, down payments, and mortgage terms.

Sarasota County Market Overview – August 2024

The Sarasota real estate market in 2024 presents a unique landscape, shaped by recent trends in both Sarasota single-family homes for sale and condos for sale.

Single-Family Homes:

- Closed Sales: 633, a slight decrease of 1.9% compared to last year.

- Median Price: $475,000, reflecting an 8.5% decline year-over-year.

- Time to Contract: The average time to secure a contract is now 45 days, a 45.2% increase. This suggests that buyers may have more leverage than last year.

- Months Supply: Inventory has increased to 4.6 months, up by 39.4%, indicating a shift towards a more balanced market.

Condos:

- Closed Sales: 217, a notable decrease of 22.2% from last year.

- Median Price: $345,000, down by 10.5%.

- Time to Contract: Condos are taking longer to sell, with the average time to contract now at 72 days—an increase of 56.5%.

- Months Supply: The supply of condos has increased to 5.5 months, up by 57.1%, giving buyers more options compared to previous months.

What This Means for Buyers: These statistics show that prices for Sarasota single-family homes for sale and Sarasota condos have dropped, while inventory has surged. This increase in supply gives home buyers in Sarasota more power and choices, especially since properties are not selling as fast. However, with inventory still below the level for a full buyer’s market, strategic action is key.

Affordability Challenges and Solutions

Affordability remains a significant challenge, especially for first-time home buyers in Sarasota. The National Association of Realtors (NAR) reports that first-time buyers need an income of around $80,000 to afford a typical starter home. Despite a slight increase in Sarasota housing inventory, we are still facing a 33% deficit compared to pre-pandemic levels. This scarcity continues to drive up prices, making it crucial for buyers to act swiftly and strategically.

Down Payment Assistance Programs in Sarasota: If affordability is a concern, look into local and state-level down payment assistance in Sarasota. These can be crucial in helping you afford the upfront costs of homeownership.

First-Time Buyer Strategies: Getting pre-approved for a mortgage, working with an experienced Sarasota real estate agent, and being flexible with your offer terms can help improve your chances in a competitive market.

Why Staying Informed Matters

Staying informed about mortgage rates and Sarasota housing market trends is crucial for making the best financial decisions if looking to buy here using finance. The recent increase in inventory and longer time-to-contract can present opportunities for buyers who are prepared. I’m committed to providing you with the latest updates and insights. By understanding the current market dynamics, you can better navigate the complexities of buying a home in Sarasota.

Take the Next Step

If you’re considering buying a home in Sarasota, now is the time to stay ahead of the curve. Sign up for my newsletter to receive regular housing market and mortgage rates updates, as well as expert tips to help you make informed decisions. Together, we can turn your homeownership dreams into reality.

For personalized advice and to explore your options, feel free to contact me directly at (941) 323-9780 or email me at david.heron@cbrealty.com. Let’s make your Sarasota home buying journey a successful one.

Enjoyed this article? Get More Tips, Updates, and Exclusive Insights Delivered Straight to Your Inbox!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link