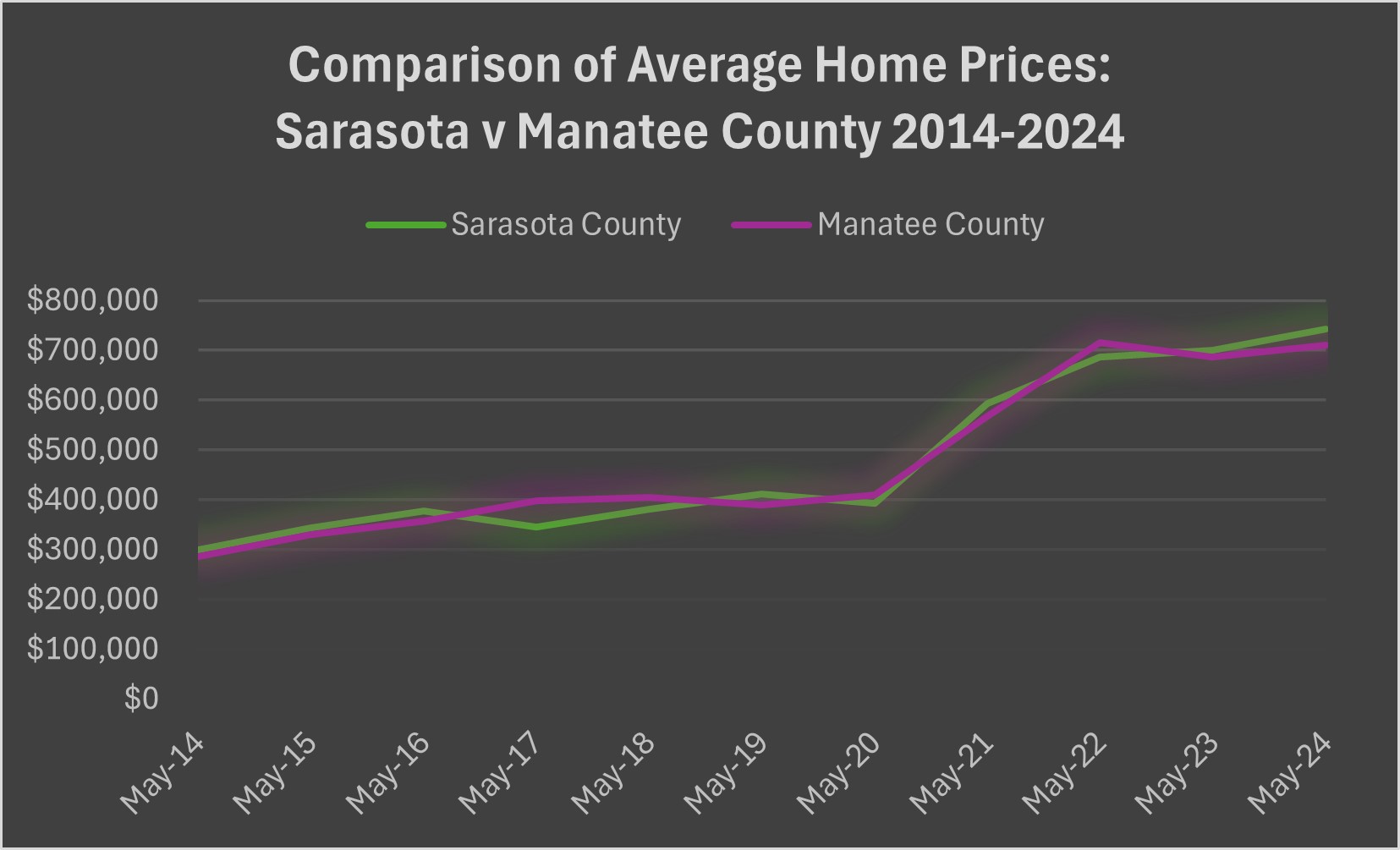

As we all know, Covid-19 has significantly influenced home prices from 2020 onwards, and we’re still navigating through its aftereffects. The scale of change, however, is quite astonishing:

Pre-Covid Trends (May 2014 – May 2020):

- Sarasota County (SC): Home prices surged by 31%.

- Manatee County (MC): Prices climbed by 42%.

- This period saw historically low interest rates, boosting the housing market’s momentum through cheap debt.

Inflation Impact:

- The Consumer Price Index (CPI) in the U.S. rose from 237.9 to 256.4 during this period, marking a cumulative inflation rate of 7.78%.

- Adjusting for inflation, real price growth was:

- Sarasota County: 23.29%

- Manatee County: 35.14%

Post-Covid Explosion (May 2020 – May 2024):

- Sarasota County: Prices astonishingly grew by 89% due to the pandemic’s fallout, changes in monetary policy incl the loosening of credit availability, and increased migration to Florida as people sought out a new life away from lockdown and covid restrictions, affecting the supply and demand of housing.

- Manatee County: Experienced a nominal price increase of 73.43%.

- After adjusting for a cumulative inflation of 21.35% during this period:

- Sarasota County: Real price growth stood at 68.04%.

- Manatee County: Real price growth was 52.08%.

These numbers indicate substantial real growth in property values, even after accounting for inflation. This highlights the dynamic nature of Florida’s housing market and underscores the significant impact of external economic factors.

What It Means for Buyers and Sellers?

For Buyers:

- Investment Opportunity: The significant real price growth in both Sarasota and Manatee Counties highlights strong investment potential. Despite higher prices, the historical growth suggests robust future appreciation.

- Market Timing: With prices having risen sharply, buyers should consider entering the market sooner rather than later to benefit from potential continued growth, especially in high-demand areas.

- Financial Planning: Factor in the high growth rate when planning your budget. Prices may continue to rise, and understanding inflation’s role can help you make informed financial decisions.

For Sellers:

- Capitalizing on Growth: If you’re considering selling, now may be an ideal time. The substantial increase in home values means you could realize significant gains on your investment.

- Strategic Pricing: Given the strong market growth, work with a real estate expert to price your home competitively to maximize returns without pricing out potential buyers.

- Timing the Market: Monitor local market trends closely. While growth has been significant, timing your sale to coincide with peak demand can further enhance your profits.

Inflation Insight:

- The adjusted real growth rates show that housing prices have outpaced inflation, indicating real increases in property value. This is vital for both buyers and sellers to understand as it affects overall affordability and investment returns.

Key Takeaways:

- Sarasota County (SC): Despite high inflation, real estate in SC has shown exceptional growth, suggesting strong market health and investment potential.

- Manatee County (MC): Also experiencing significant real growth, MC offers lucrative opportunities for sellers and serious considerations for buyers.

Enjoyed this article? Get More Tips, Updates, and Exclusive Insights Delivered Straight to Your Inbox!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link