The following analysis is based on the latest housing market data currently available from the REALTOR Association of Sarasota and Manatee (RASM), covering activity through November 2025. As with all real estate data, this represents a snapshot in time, but it provides the clearest, most up-to-date insight we have into how the Sarasota and Manatee markets are behaving right now.

Headline statistics can be misleading when viewed in isolation. County-wide averages often mask significant differences between property types, price points, and local conditions. The November 2025 RASM report highlights this clearly: there is no single “Sarasota–Manatee market,” but rather four distinct micro-markets, each with its own dynamics.

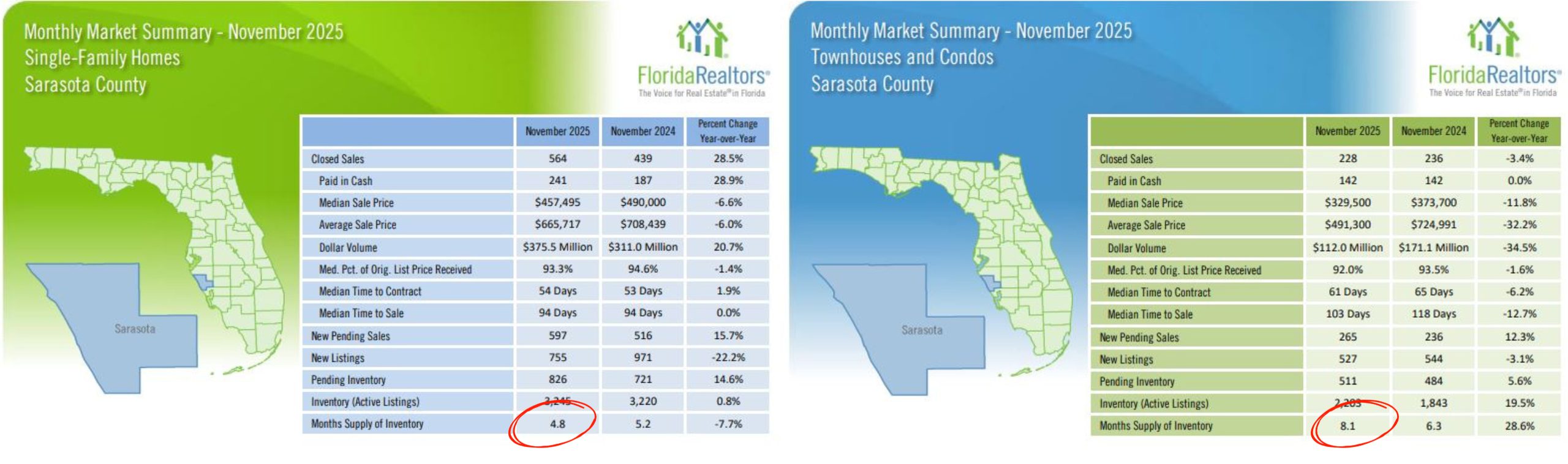

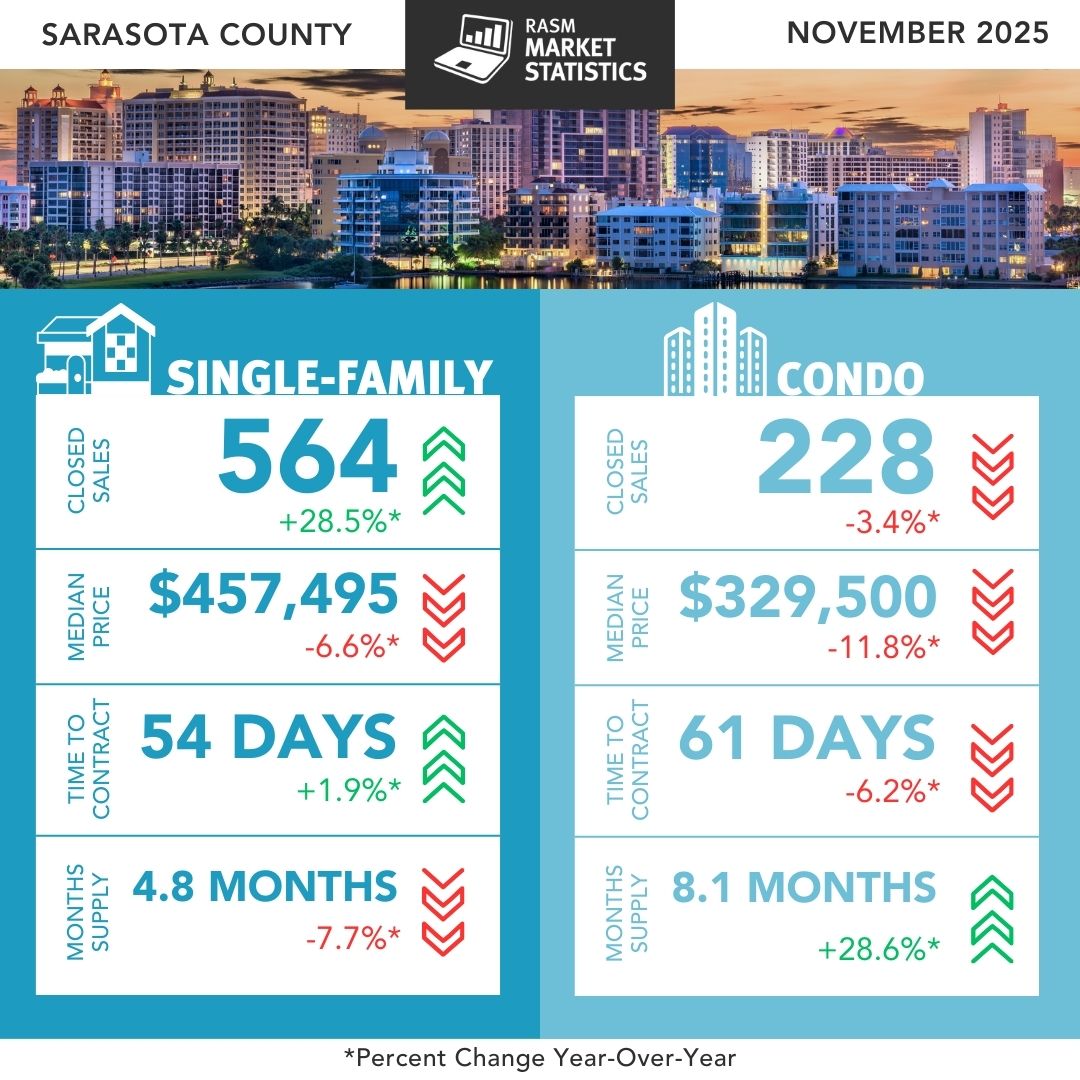

For example, Sarasota County condos are currently sitting at an 8.1-month supply of inventory, while Sarasota single-family homes have just 4.8 months of supply. A gap large enough to create entirely different negotiating environments. Below, we break the data down segment by segment to explain what’s actually happening, and what it means for buyers and sellers.

Sarasota County Housing Market: A Tale of Two Markets

In Sarasota County, the single-family and condo markets are moving in opposite directions, reinforcing why broad market narratives often miss the point.

Sarasota Single-Family Homes: Sales Rebound Off a Disrupted Baseline

One of the most eye-catching figures in the November 2025 report is the 28.5% year-over-year increase in single-family home sales in Sarasota County. At first glance, this looks dramatic but it’s important to view the comparison in context.

November 2024 was materially disrupted by hurricane activity, which temporarily slowed showings, contract activity, and closings across the region. As a result, last year’s sales figures were artificially suppressed, making the year-over-year rebound in November 2025 appear more pronounced than it would under normal conditions.

That said, the rebound is still meaningful. The median sale price declined 6.6% to $457,495, inventory remained essentially flat year-over-year, and homes went under contract in a median of 54 days. Taken together, this suggests the market is not overheating, but rather functioning more normally after a period of disruption.

In practical terms, price normalization (combined with a return to typical transaction volumes following last year’s hurricane-related slowdown) has allowed buyer activity to recover without increasing supply pressure.

Sarasota Condos & Townhomes: A Clear Buyer’s Market

The condo and townhome segment tells a very different story. Closed sales slipped 3.4% year-over-year, while the median sale price fell 11.8% to $329,500. The defining factor here is supply.

Active condo inventory in Sarasota rose 19.5% year-over-year, pushing months of supply to 8.1 months, firmly into buyer’s-market territory. In real terms, this gives buyers more leverage on price, concessions, and contract terms.

Cash transactions accounted for 62.3% of condo sales, which is typical for Florida and reflects continued investor, second-home, and downsizer activity. However, rising carrying costs (particularly property insurance premiums, stricter reserve requirements, and escalating HOA fees) are placing pressure on condo owners and contributing to increased resale inventory.

This is not a collapse, but a supply-driven correction.

Manatee County Housing Market: A Different Set of Dynamics

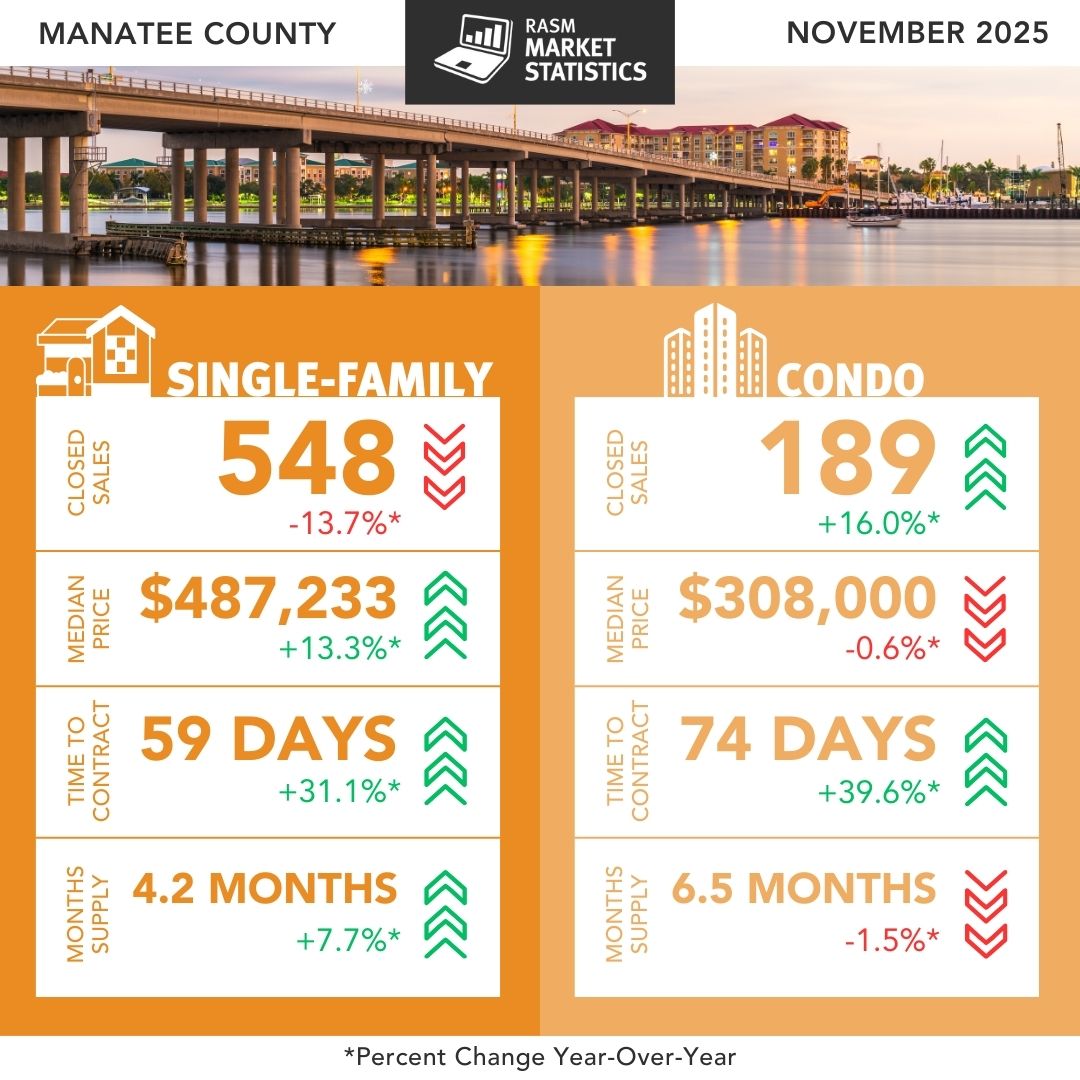

Manatee County presents almost a mirror image of Sarasota, with relative strength in condos and softer conditions in single-family homes.

Manatee Single-Family Homes: Prices Rise as Momentum Slows

In Manatee County, single-family home sales declined 13.7% year-over-year, yet the median sale price increased 13.3% to $487,233. Importantly, RASM notes that this price growth is largely driven by a shift in the mix of homes sold, rather than broad-based appreciation.

A key momentum indicator reinforces this point: the median time to contract increased 31.1% to 59 days. While inventory remains relatively tight at 4.2 months, buyers are becoming more selective. Homes priced too aggressively are taking longer to attract offers, increasing carrying costs and negotiation risk for sellers.

Headline price growth alone, therefore, does not tell the full story.

Manatee Condos & Townhomes: Relative Stability and Affordability

Manatee’s condo and townhome market stands out as one of the more balanced segments in the region. Closed sales increased 16.0% year-over-year, while the median price remained nearly flat at $308,000.

With 6.5 months of supply, this segment sits close to equilibrium. It appears to be absorbing demand from buyers priced out of the single-family market or seeking lower entry points into the region. Activity is steady rather than frenetic, reflected in a median 74 days to contract.

Single-Family Homes vs Condos in Florida: Why the Divide Exists

The divergence between property types is not accidental. Single-family homes continue to benefit from limited new construction and sustained lifestyle demand for space and privacy.

Condo markets, by contrast, are far more sensitive to changes in operating costs. In Florida, rising insurance premiums, new reserve requirements, and escalating HOA fees disproportionately affect condos. These costs impact affordability even when headline prices decline, prompting some owners to reassess their positions and increasing resale inventory, particularly in Sarasota.

Understanding this structural difference is essential when interpreting current market data.

What the Latest Data Means for Buyers in Sarasota & Manatee

This is a market of opportunity, but strategy matters.

- Sarasota condo buyers: Elevated inventory and longer selling timelines provide meaningful negotiating leverage.

- Manatee condo buyers: Expect balance rather than distress. Be selective, but realistic.

- Sarasota single-family buyers: Price normalization has created a window of opportunity, though well-priced homes still attract competition.

- Manatee single-family buyers: Patience is an asset. Rising days on market suggest pricing may be approaching a plateau.

What the Latest Data Means for Sellers

Correct pricing from day one has never been more important.

- Sarasota condo sellers: Competition is intense. Overpricing in an 8-month supply environment risks extended market time.

- Manatee condo sellers: Demand exists, but buyers are deliberate. Expect a 2–3 month marketing period.

- Sarasota single-family sellers: The market remains functional but price-sensitive.

- Manatee single-family sellers: Rising days to contract are an early warning sign. Headline price growth alone should not guide pricing strategy.

Final Thoughts

The latest available data through November 2025 confirms that broad generalizations no longer work. The Sarasota& Manatee housing markets aren’t crashing, they’re rebalancing, and that process is unfolding unevenly across counties and property types.

Temporary disruptions, such as last year’s hurricane activity, can distort year-over-year comparisons. Once those effects fade, what emerges is a market that is more rational, more segmented, and more dependent on precise pricing and strategy.

County-wide averages don’t sell homes, micro-market strategy does. If you want a clear, data-driven view of your specific neighborhood, price bracket, and property type, I’m happy to walk you through it.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link