A Data-Driven Breakdown of the Latest Full-Year Market Report

As we start 2026, the official year-end 2025 housing market data for Sarasota and Manatee Counties has now been released. This is the most complete and reliable snapshot we currently have of how the local market behaved across the entire year.

While national real estate headlines often paint markets with a broad brush, the year-end data shows something far more nuanced locally. 2025 was not a year of uniform trends. Instead, it marked a period of recalibration, where different property types in each county moved in very different directions.

This breakdown looks beyond the headlines to explain what actually happened in 2025 and what buyers and sellers should take from it as we move into 2026.

The Big Picture: A Market Moving in Different Directions

Across Sarasota and Manatee Counties, the defining theme of 2025 was divergence.

- Single-family homes generally showed resilience and stabilization

- Condos and townhomes, particularly in Sarasota, faced structural headwinds that drove sharper price adjustments

This was not a market crash. It was a supply demand correction, shaped by uniquely Florida-specific factors such as insurance costs, HOA requirements, and reserve regulations.

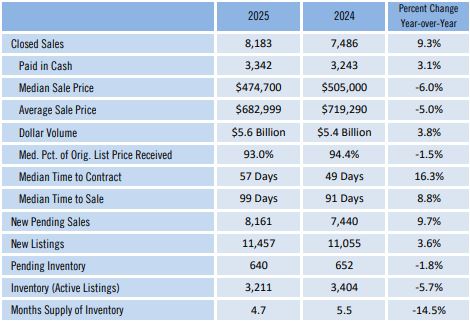

Sarasota County Housing Market 2025

Single-Family Homes: Resilient Demand, Normalising Prices

Sarasota’s single-family home market remained active throughout 2025.

- Closed sales increased 9.3% year over year

- Median sale price declined 6.0% to $474,700

- Inventory tightened to 4.7 months of supply

- Median time to contract increased to 57 days

What this means:

The increase in sales volume confirms that buyer demand remained intact. The price dip reflects a healthy normalization from the elevated levels seen in 2024, not a loss of confidence. Inventory levels point to a balanced market where things are active, but no longer frenetic. Homes are taking longer to sell, but they are still selling.

Condos & Townhomes: A Buyer’s Market Takes Hold

The Sarasota condo market experienced the most pronounced adjustment in 2025.

- Closed sales declined 4.3%

- Median sale price fell 15.3% to $325,000

- Average sale price dropped 26.7%

- Inventory rose to 8.1 months of supply

What this means:

This is a textbook buyer’s market. The sharp drop in average prices indicates that higher-end condos absorbed the largest corrections, while rising inventory created significant negotiating leverage. This adjustment is being driven less by demand collapse and more by rising ownership costs, including insurance premiums, reserve requirements, and HOA expenses.

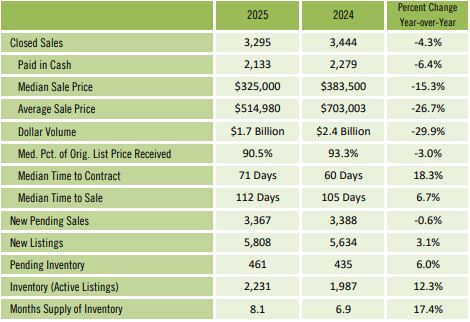

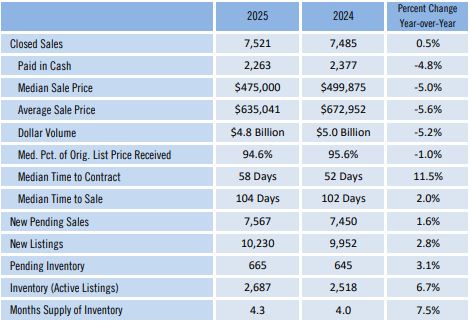

Manatee County Housing Market 2025

Single-Family Homes: Stability Over Spectacle

Manatee County’s single-family market was one of the most balanced segments in the region.

- Closed sales were essentially flat (+0.5%)

- Median sale price declined 5.0% to $475,000

- Inventory increased modestly to 4.3 months

- Median time to contract rose to 58 days

What this means:

This is what a normal market looks like. Neither buyers nor sellers held a clear advantage in 2025. Price adjustments were modest, and demand remained steady. For many buyers, this segment offered predictability rather than opportunity or risk.

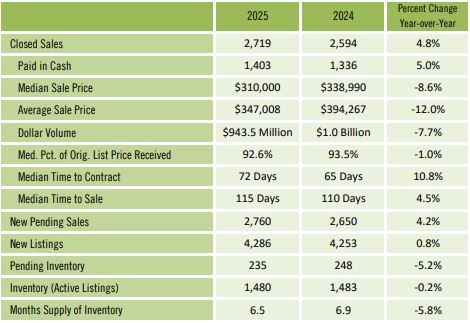

Condos & Townhomes: More Resilient Than Sarasota

Manatee’s condo market stood out for its relative stability.

- Closed sales increased 4.8%

- Median sale price declined 8.6% to $310,000

- Inventory improved to 6.5 months of supply

- Median time to contract increased to 72 days

What this means:

Manatee’s lower price points attracted buyers even as the broader condo market softened. While prices still adjusted downward, the magnitude was significantly less than in Sarasota. The market remains close to balanced, with neither extreme competition nor distress.

What the 2025 Data Means for Buyers

Single-Family Buyers

You are entering a balanced, rational market. The urgency of previous years has faded, giving you more time and leverage in negotiations. Prices have already adjusted, meaning today’s numbers should be viewed as a new baseline, not the start of a downturn.

Condo & Townhome Buyers

You have leverage (especially in Sarasota) but diligence is critical. Buyers must carefully review:

- HOA financials and reserve funding

- Pending or potential special assessments

- Insurance availability and cost

The 15% median price decline in Sarasota condos reflects the market pricing in these risks, not panic selling.

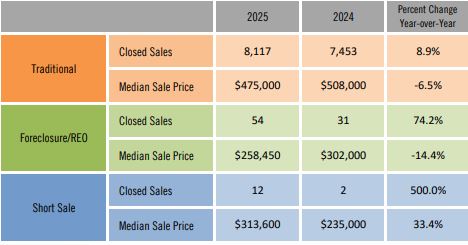

Strategic Outlook for 2026

The year-end 2025 data confirms that this market is recalibrating, not collapsing. Distressed sales remain statistically insignificant, and demand has not disappeared, it has simply become more selective.

Success in 2026 will depend on understanding micro-markets, not relying on broad narratives. Single-family homes offer stability, while condos present opportunity for buyers willing to do the work.

The takeaway is simple: This is a thinking market. Calm analysis, realistic pricing, and an understanding of total ownership costs matter more now than momentum or speculation.

Want to understand how these 2025 trends apply to your situation? Whether you’re buying now or planning for 2026, I’m happy to walk through the numbers for your specific neighborhood, price range, and property type.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link